Social security wages calculation w2

File Online Print - 100 Free. For more information on how to calculate the federal withholding amount please see TSOP 301.

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Ad Deciding When To Claim Your Social Security Benefits Can Be Tricky.

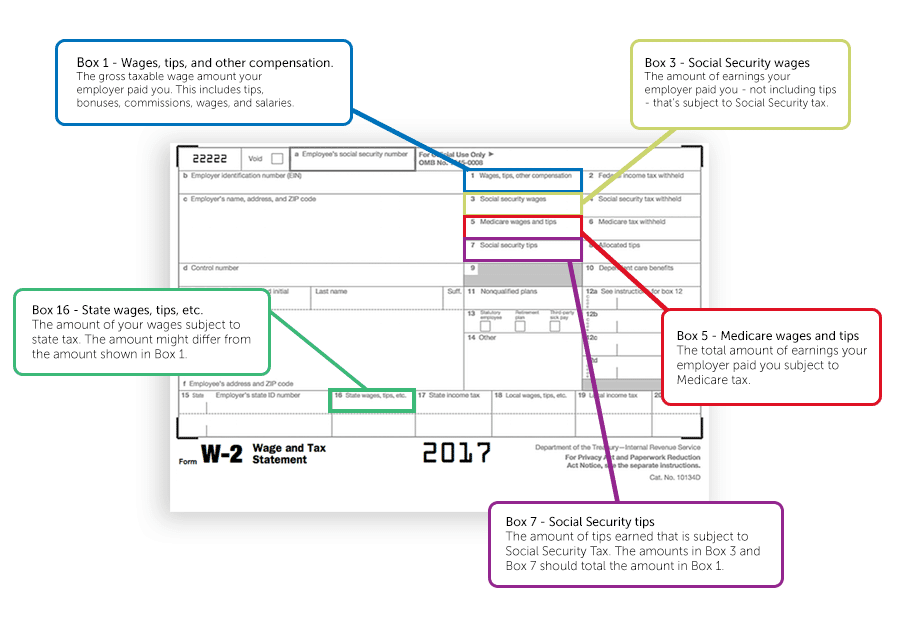

. 2 File Online Print - 100 Free. If your box 3 amount differs from box 5. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income.

2 File Online Print - 100 Free. We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 - Start For Free.

Wages Tips and Other Compensation. Ad Use Our W-2 Calculator To Fill Out Form. Your EFW2 file must have a TXT or ZIP extension to use the new Wage File Upload process.

1 Use Our W-2 Calculator To Fill Out Form. The HI Medicare is rate is set at 145 and has no earnings. However there is a maximum amount of wages that is.

In 2022 it is. I assume youre referring to the Box 3 amount. There is a three-step process used to calculate the amount of Social Security benefits you will receive.

The most common questions relate to why W. Use your earnings history to calculate your Average Indexed. Attention Tax Year 2021 Wage Filers.

Thats your wages that are subject to the Social Security portion of FICA as opposed to the Medicare portion which is in Box 5. 1 Use Our W-2 Calculator To Fill Out Form. So benefit estimates made by the Quick Calculator are rough.

The formula breaks down your average monthly wage into three parts. The net amount of this calculation should equal the taxable wages reported on your W-2 for social security box 3 and Medicare box 5. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 - Start For Free. Most of these questions focus on understanding the amounts in the numbered boxes on the W-2. Plus 32 percent of any amount over 1024 up to.

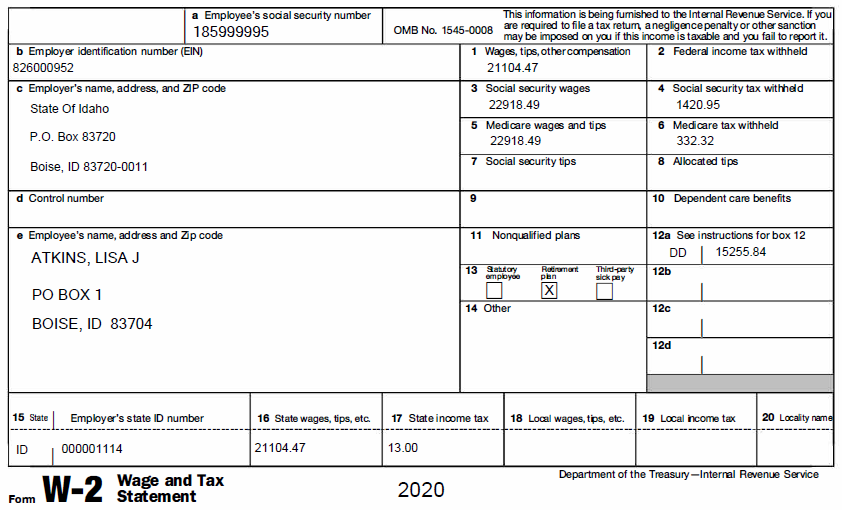

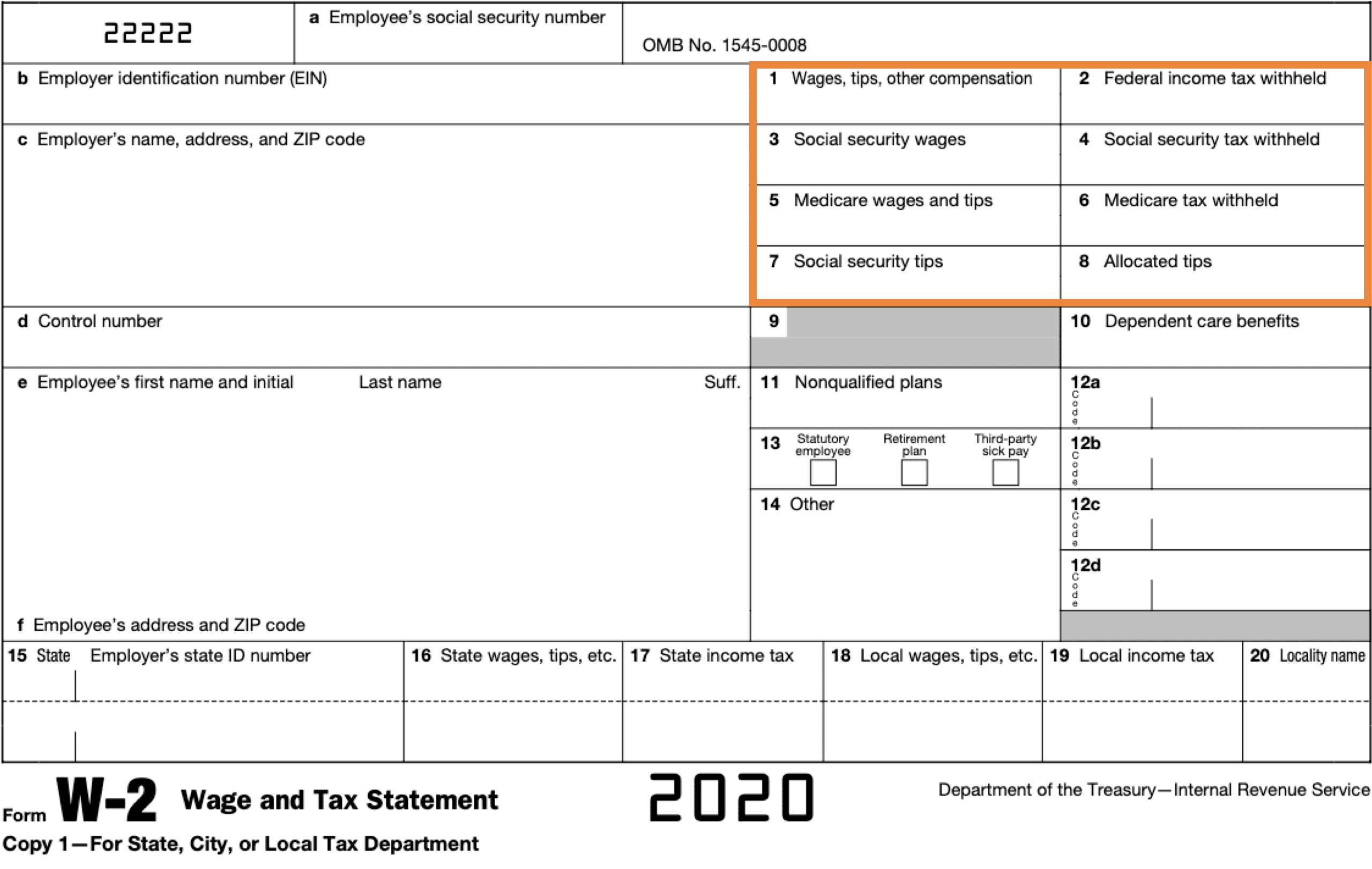

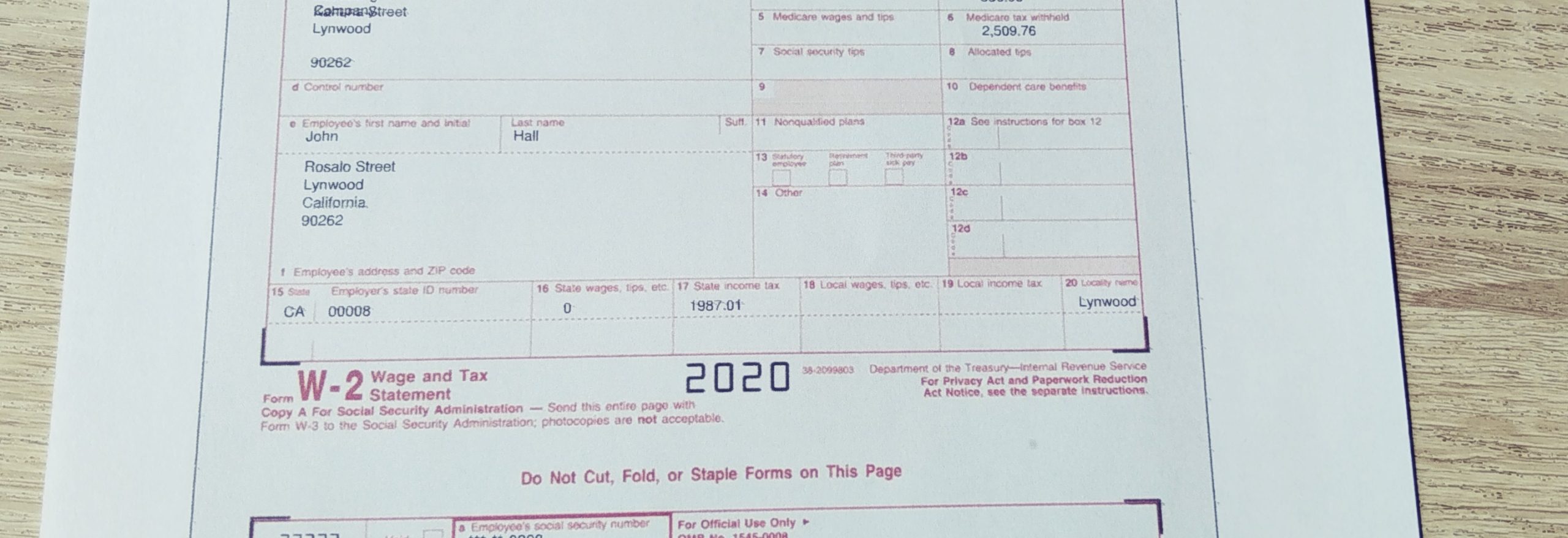

Tax Forms Made Simple - Save Time File Instantly With The IRS - Export To PDF Word. Answer 1 of 2. Payroll receives many questions about the W-2.

You can get free copies if you need them for a Social Security. If you file your federal. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400.

Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points. Ad 1 Get A Fillable W-2 Form Tailored To Your Needs. Box 1 shows the amount of gross taxable wages an employer paidThese wages include tips bonuses commissions and salaries.

90 percent of the first 1024 of your AIME. 2 Print File Instantly - 100 Free. Wage reports for Tax Year 2021 are now being accepted.

This amount should be equal to the amount shown on your W-2. Your combined income is calculated by adding your adjusted gross income nontaxable interest and one-half of your Social Security benefits.

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Reading Your W 2 Wage And Tax Statement

Your W 2 Employees Help Center Home

A Quick Guide To Your W 2 Tax Form The Motley Fool

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Calculate W2 Wages From Paystub Paystub Direct

How To Read And Understand Your Form W 2 At Tax Time Tax Forms W2 Forms Power Of Attorney Form

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Your W 2 Controller S Office

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Form W 2 Explained William Mary

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number